After the sharp drop in the stock and crypto markets along with many policies being enacted to cool the real estate market, many investors were left in a state of anxiety about whether there would be an exit from the market. Whether or not, the psychology of investors surfing is stable in the wave of credit restrictions, control of subdivisions for sale or tighter taxes in real estate transactions. Summary of some highlights in the report just published by Batdongsan.com.vn on July 5, 2022 in HCM:

1. It is increasingly difficult for young people to buy apartments when primary and secondary prices increase (4-7%) in the context of limited supply

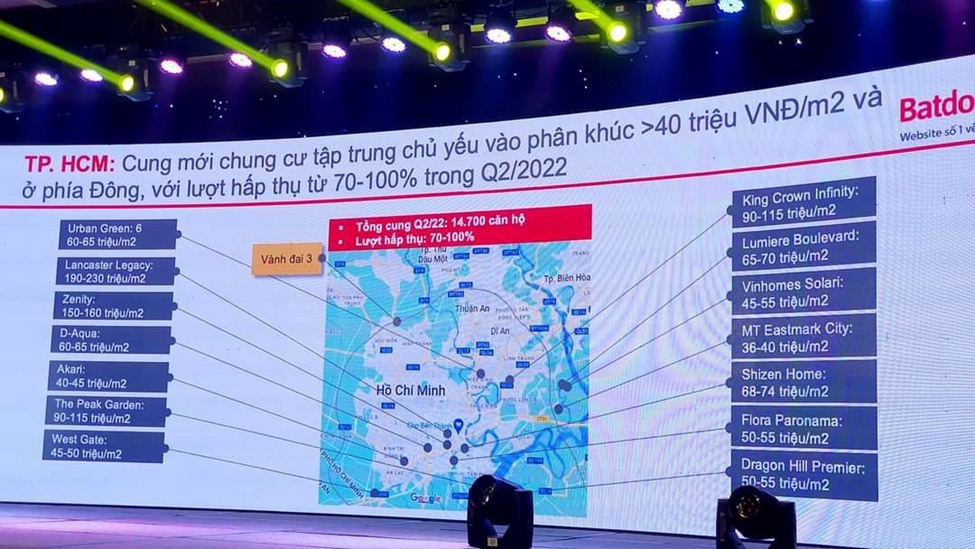

The average income of people in Ho Chi Minh City is about 180 million / year, while the price for an average apartment offered for sale in the market is about 3 billion / apartment, which means to own Owning an apartment needs to work continuously for 15-20 years. The total new supply in the first 6 months of the year is about 14,700 apartments (14 projects), mainly in the eastern region and the average price is > 50 million with a relatively good absorption rate of 70-100%.

Although the absorption rate is relatively good, the demand for apartments decreased in May-June when banks began to restrict credit to the high-end and super-luxury segments, a small part of investors. Surfer accepts stop loss to ensure stable cash flow.

2. Land plots still have long-term prospects with rising prices in most provinces, although interest has cooled down compared to the same period last year.

More than 53% of the surveyed people still think that land plots are a potential investment channel in the second half of 2022 despite credit restrictions, and subdivision of plots in the northern and southern provinces, the amount of interest and transactions fell sharply, but it was accompanied by a strong price increase of 10-30% in the Southeast provinces.

Ring Road 3 – Important infrastructure that contributes to changing the economic landscape and reducing the load on existing roads to the Southeast provinces has been accelerated by the People’s Committee and is expected to start construction before June 2023. Growth triangle International Airport – Cai Mep Port – Ho Chi Minh City Creative City along with expressways deployed synchronously is expected to create a regional cargo transshipment hub to replace international airports. Hong Kong, Singapore or Thailand.

(Long Thanh land price increased 5 times since the beginning of the project to deploy Long Thanh international airport)

3. Cash flow shelters looking for opportunities to return in the rental and sale segment of townhouses

After nearly 2 years of being strongly affected by the Covid epidemic, the street house segment began to prosper with the return of production and business enterprises, students returning to school and customs clearance for their families. foreigner. The rental rate of townhouses started to increase again from 2.7% to 3% and the street price in the central districts increased sharply in both Hanoi and Ho Chi Minh markets (increased from 2-20%).

When other investment channels such as stocks, crypto, gold are unattractive, smart cash flows choose to return to the townhouse segment for shelter with monthly cash flow expected to offset the increase in interest rates to save money. inflation in the near future.

4. Take a break and wait for the time – Double damage

After nearly 2 years, this is a rare real estate segment that has not recovered when the interest level is still 40% lower than 2020, still a story around 3 “yet”, (1) no concept yet. specific about tourism real estate in legal documents on real estate business (2) have not specified specific sanctions on the responsibility of commitments and (3) have not yet recognized legal ownership (pink book).

The resort market in this period is suffering double losses when tourism has not yet recovered, world tourism spending is affected by rising inflation in Europe and the US, credit is tightened but the quantity of supply is limited. on Batdongsan.com.vn increased from 21 projects to 37 projects.

Every 10 years, the revised land law will have a land fever or legal framework creating the basis for the birth of many types of real estate, and 2023 will be the pivotal year waiting for the complete legal framework. and the strong recovery of the tourism/resort market.