SHARE 8 EXPERIENCE WHEN BUYING A HOME

Step 1: Determine your needs carefully

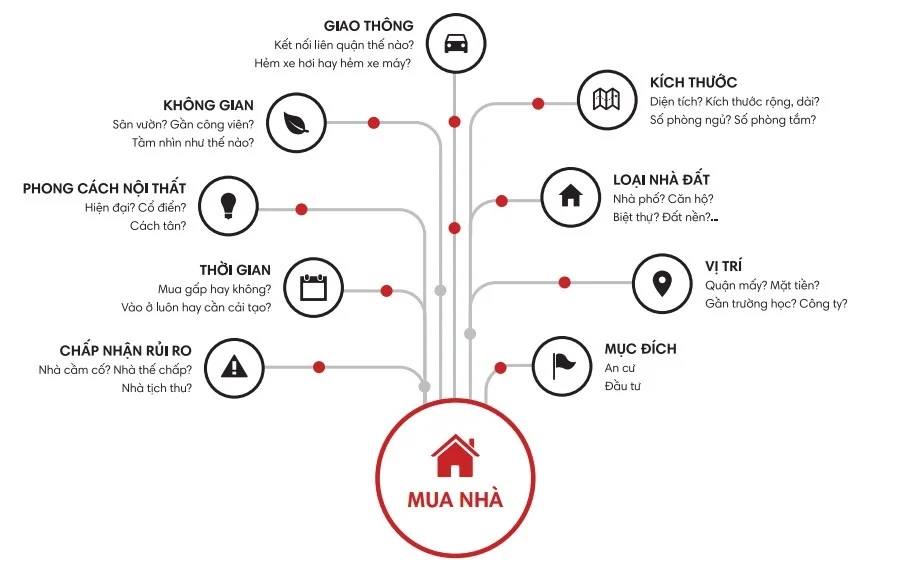

Take time to thoroughly define which home you and your family want: how many bedrooms are the minimum, the size of the minimum, the location of the house, the neighborhood you want, whether it’s close to the school, hospital. Or agency? Understanding the need seems simple and often overlooked by many people. However, if you determine the right and enough demand, you will narrow the scope of searching for houses among hundreds of thousands of real estate transactions on the market. Increase the ability to evaluate the home, the ability to make accurate decisions and shorten the time to buy and sell a home.

Determining the right and enough needs also reduces the financial pressure when you choose to buy an apartment with a large area that your family does not use up.

Step 2: Determine the budget

Once you have identified a home that fits your family’s needs, you will need to continue to determine your budget and finances.

– If you have accumulated enough money to buy a house, everything will be much simpler. You only need to calculate the transfer costs, home improvement fees, furniture expenses and moving furniture costs accordingly within your financial capacity.

– In case you have not accumulated enough money to buy a house, choose a house so that the amount you have available is about 30% of the value of the house. Currently, banks support home loans to reach 70% of the value of the house when mortgaging the main house and up to 90% of the value of the house if mortgaging with another real estate. Average lending rates range from 5% to 14% depending on the bank, loan package, apartment value and loan term.

The advice is that you should only borrow 50% of the value of the apartment to avoid financial pressure if possible. From there, calculate the actual home buying budget based on the ability to pay. From that budget you will find it easier to find a home. Read through 9 notes that cannot be ignored when borrowing money to buy a home to know how to calculate a loan with income.

Also, don’t forget to include transfer fees for titles in administrative proceedings, home improvement fees and moving service fees. These fees are small, but make sure you budget them and control your budget too much.

Step 3: Start searching for real estate

Start your home search from the home and budget needs you’ve listed above. There are 3 basic ways for you to search for a home as follows:

Inquire about personal relationships: friends, co-workers and relatives can find out which units are on sale to suit your needs and budget. Don’t forget to ask them and

Self-search with the Internet: With the traditional way of searching for homes, buyers usually search for house sale boards or realtors in their desired destination area. However, in the past 5 years, the way of searching for homes has changed a lot thanks to the advent of the Internet, classifieds websites, social networking sites. Searching by the Internet will reduce the search time, and at the same time, buyers can easily access the latest and most diversified sale information to have more options. Choose a suitable home search page, with information that is regularly updated and reputable. Searching by Google is very susceptible to information confusion because you will not know what is the latest information. Listing for sale has not been verified and sometimes does not contain full images. Should choose a website that ensures the authenticity of information, has detailed images and has direct contact from the owner.

Search through real estate transaction systems: Real estate brokerage, Real estate transaction systems in each locality often own houses with good prices that do not post online information. They are also an expert in the home buying process, know the area you want, work directly with the landlord, know the exact value of the house and have good negotiation skills.

Step 4: Check the house

After finding the right home, you need to do a physical inspection of the house again to easily make a choice decision.

If you work with a real estate transaction system or a broker, ask them to arrange a visit and accompany you. The details you need to keep in mind will include: traffic conditions, the entrance to the house, the structure of the house, the newness of the house, the exterior, etc. If inexperienced, please refer to detailed home viewing instructions recommended by experts.

Do not forget to write down the strengths and weaknesses of the house and photos of the details you care about for easy comparison later. These are also details that easily give you an advantage when negotiating prices with the landlord.

Step 5: Compare and make decisions

After visiting, you need to compare the apartments to see if they are the “dream home” of the family. If not, keep looking for more. In the event that you see a number of suitable homes, you should still compare their strengths and weaknesses and decide which one to choose.

At this point, you need to review your needs list, your financial budget, and measure and measure. A home that meets the family’s set needs, doesn’t exceed budget, has defects that can be renovated in the future or you can accept them, is the home that suits you best.

In case more advice is needed when making a decisionPlease ask your broker to compare and analyze it for you. In addition to home assessment information, they will often give you more advice on the home’s potential for an increase in price. This information is often determined through urban planning information, transport infrastructure development information and major projects to be built around.

Step 6: Negotiation

Once you’ve decided on which home to buy, you need to start negotiating as soon as possible. The homes with good prices are often traded quickly. Please proceed to ask about buying with a landlord in a good faith, close manner. Creating a love for the landlord, you will easily buy the house again even though many others also buy it at a price even better than you offer.

When negotiating, you shouldn’t focus too much on your final asking price. Instead, you should also pay attention to the house value overview and consider increasing your down payment, cutting down on risks, or suggesting an earlier closing date. Try to show in writing all agreements and exchanges between the two parties to avoid future disputes.

Step 7: Close the transaction

When you and the seller agree to transact with each other, you will step into the process of closing the transaction, making a deposit, making the transfer paper usually takes 15 to 30 days. During this phase, always keep in touch with the host to avoid last minute changes. At the same time, do not forget to ask in advance about administrative procedures when transferring to avoid disputes or disagreements arising between the two parties.

If you buy an apartment or you need a bank loan, this is the time to quickly implement the procedures. Careful preparation of loan applications will reduce bank review time.

Make sure the witnesses and evidence for the delivery of your money to avoid incurring any risks. If you can transfer, transfer the money to buy a house for a certificate from the bank. If the conditions do not allow, the transaction should be done when notarizing the transfer document at a law agency. Or have a separate witness on behalf of each participating party to witness and sign the proof of transaction.

Step 8: Manage post-transaction and delivery

This is when you can feel more secure about the transaction process. Now is the time to take over the house and prepare to move in. Whether or not your home is ready or not, there will probably be some maintenance and remodeling you want to finish before you move. You should also think about hiring carriers, buying new furniture and equipment, setting up your gadgets, etc.

In addition, it is important to keep in touch with your local administrative office to make sure your new ownership certification process goes smoothly.

Source: RV