Recently there has been a lot of information and debate about tightening credit room, many people are worried about the possibility that credit will continue to be tightened further in the last 6 months of the year, leading to the freezing of the real estate market. Is the truth like that?

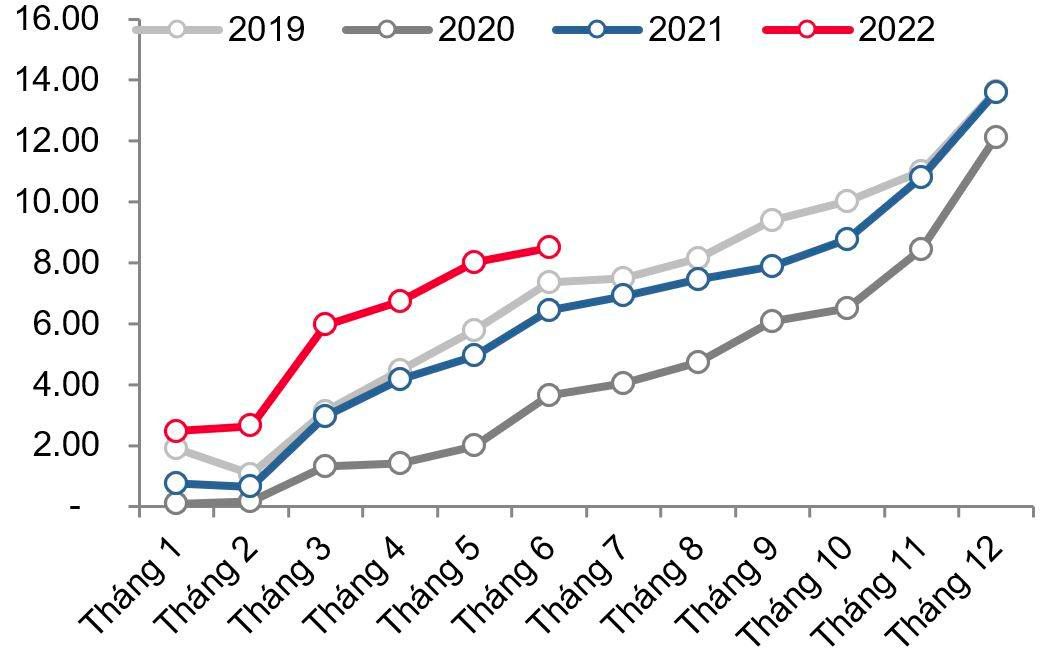

Looking at the big picture, credit still grew very well in the first 6 months. According to the SBV’s report, total credit outstanding increased by 9.35% in the first half of 2022, much higher than the increase in the last 3 years, which proves that credit is not tightened.

So why is tightening the credit room a hot topic of discussion recently? The fact that banks lend too quickly in the first months of the year, leading to the use of credit room, has been limited in lending recently. In a nutshell, the SBV gave a credit growth cake and banks ate it too quickly, so there’s nothing left to eat lately. The important thing is that the cake distributed by the State Bank this year is still bigger than previous years, showing a growth rate of 9.35%.

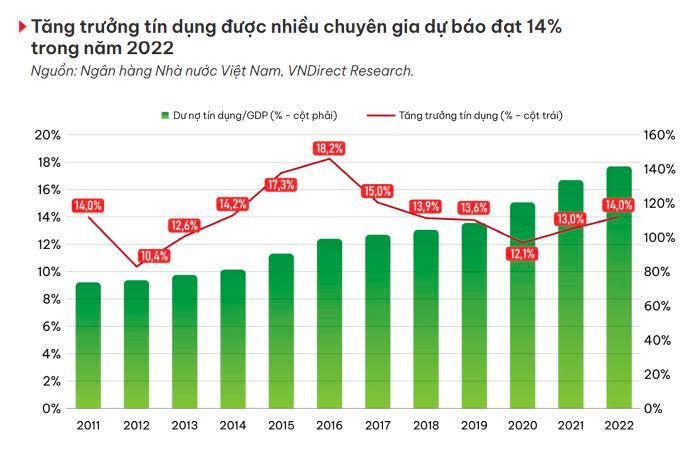

What will the picture look like from now to the end of the year? The State Bank is committed to achieving the credit growth target of 14% for 2022, higher than the last 3 years. Therefore, in order to achieve this goal, the credit room will certainly be widened in the remaining months.

In short, if you look at what has happened recently, many people feel worried about “squeezing the credit room”. However, if looking at the overall picture in 2022, the credit room will still be widened, growing 14% and higher than in recent years.

So should we be pessimistic or optimistic for the 2022 outlook?